Tech

Google Invests $1 Billion in Subsea Fiber-Optic Cable Connecting Africa and Australia

Google has announced plans to con- struct a subsea fiber-optic cable connecting Africa and Australia,

a project that promises to revolution- ize digital connectivity and economic growth across the continent.

The new cable, dubbed “Umoja,” which is Swahili for “unity,” will directly link Africa and Australia, reducing latency and enabling faster data transfer between the two continents.

The announcement, made on May 23, 2024, marks a significant milestone in Google’s ongoing efforts to bridge the digital divide and empower communities globally.

The project is expected to take several years to complete, with a estimated completion date of 2026.

The Umoja cable will start in Kenya and run through various countries, including the Democratic Republic of the Congo, Rwanda, Uganda, Zambia, Zimbabwe, and k Africa, before crossing the Indian Ocean to Australia. The terrestrial part of the route is already complete, with Google collaborating with Liquid Intelligent Technologies on the project.

According to Brian Quigley, VP for Global Network Infrastructure at Google Cloud, “Umoja will enable African countries to more reliably connect with each other and the rest of the world.

Establishing a new route distinct from existing connectivity routes is critical to

maintaining a resilient network for a region that has historically experienced high-impact outages.”

The project has garnered enthusiastic support from various stakeholders, including Meg Whitman, the U.S. Ambassador to Kenya, who emphasized the project’s significance for Kenya’s digital transformation journey. “This is a momentous occasion,” she remarked.

“Access to the latest technologies, underpinned by dependable and resilient digital infrastructure, is essential for fostering economic opportunities.”

Google’s investment in the Umoja cable is a testament to the company’s ongoing commitment to promoting digital inclusion and fostering sustain- able economic growth in Africa. As the project progresses, it is expected to have a transformative impact on the digital landscape of the continent, paving the way for a future of enhanced connectivity, economic opportunity, and global collaboration.

With the Umoja cable, Google is poised to play a critical role in shaping the future of digital connectivity in Africa, empowering businesses, communities, and individuals to fully leverage the potential of the digital age.

Business

Tesla Loses Top Spot as BYD Overtakes in Global EV Sales

Tesla Loses Top Spot as BYD Overtakes in Global EV Sales

Tesla has reported lower-than-expected vehicle sales in the fourth quarter of 2025, losing its position as the world’s largest electric vehicle (EV) maker by annual sales to Chinese auto giant, BYD.

The American EV manufacturer, led by billionaire entrepreneur Elon Musk, said it delivered 418,227 vehicles in the final three months of 2025, bringing its total deliveries for the year to about 1.64 million units.

In contrast, a day earlier, Shenzhen-based BYD announced that it sold 2.26 million electric vehicles in 2025, overtaking Tesla to emerge as the global market leader in EV sales.

Analysts had projected a stronger performance from Tesla in the fourth quarter, with a FactSet consensus estimating deliveries of about 449,000 vehicles.

The shortfall has heightened concerns over slowing demand for electric vehicles, particularly in the United States.

Industry analysts noted that the removal of the $7,500 federal EV tax credit at the end of September 2025 has continued to weigh on consumer demand in the US market, with the sector yet to find a new equilibrium.

However, observers point out that Tesla’s sales challenges predated the policy change, as the company had already been struggling in some key markets.

This, analysts said, was partly linked to the political activities of its chief executive, Elon Musk, including his public support for US President Donald Trump and other far-right politicians, which reportedly affected consumer sentiment.

Tesla is also facing intensifying competition from Chinese manufacturers, particularly BYD, as well as from established European automakers ramping up their EV offerings.

BYD, which produces both fully electric and hybrid vehicles, on Thursday disclosed that it recorded its highest-ever EV sales in 2025, underlining the growing dominance of Chinese firms in the global electric vehicle market.

The development signals a major shift in the rapidly evolving EV industry, with analysts predicting stiffer competition and further pressure on global automakers in the coming year.

Tech

Secret Service Foils Telecom Plot to Cripple New York Networks

Secret Service Foils Telecom Plot to Cripple New York Networks

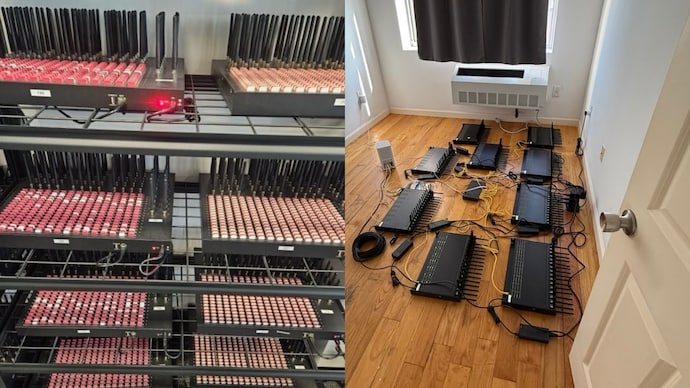

The United States Secret Service has disrupted a sophisticated telecommunications network capable of shutting down cellular systems in New York City as world leaders gather for the United Nations General Assembly (UNGA).

The agency disclosed on Tuesday that, in August, it discovered more than 300 SIM servers and 100,000 SIM cards in parts of New York, New Jersey, and Connecticut.

“This network had the power to disable cell phone towers and essentially shut down the cellular network in New York City,” said Matt McCool, a special agent in charge of the operation.

Officials said the devices were uncovered within 35 miles (56km) of the UN headquarters, where over 100 world leaders and delegations are meeting for the 80th UNGA anniversary.

McCool described the operation as a “well-organised and well-funded scheme” linked to nation-state actors, organised crime groups, cartels, and terrorist organisations.

Investigators believe the equipment could send text messages to the entire US population within 12 minutes, disable mobile towers, and even disrupt emergency communications through denial-of-service attacks.

The Secret Service confirmed that the equipment was seized from SIM farms operating out of abandoned apartments spread across at least five sites, though exact locations were not disclosed.

According to officials cited by the New York Times, the discovery followed an investigation into telephonic threats directed at three senior US government officials earlier this year—one from the Secret Service and two from the White House.

CBS News also reported that agents recovered 80 grams of cocaine, illegal firearms, computers, and mobile phones during the raids.

The Secret Service said investigations are ongoing as leaders converge in Manhattan amid heightened security concerns.

Tech

China Accuses Nvidia of Monopoly Breach Amid Renewed US-China Trade Talks

China Accuses Nvidia of Monopoly Breach Amid Renewed US-China Trade Talks

China’s State Administration for Market Regulation has accused American chipmaking giant, Nvidia, of violating the country’s anti-monopoly laws, a charge that underscores the deepening strategic rift between Beijing and Washington over control of the semiconductor industry.

Although the regulator stopped short of disclosing specific details of the alleged violations, it confirmed that its investigation into the company would continue.

The announcement coincided with the second day of high-level trade talks between officials of both countries in Madrid, Spain.

Leading the negotiations were United States Treasury Secretary, Scott Bessent, and China’s Vice Premier, He Lifeng.

At the end of the discussions, Bessent struck a positive note, describing the exchanges as “very good,” while disclosing that a fresh round of talks would be held next month.

The Madrid meeting also broached the issue of TikTok, the Chinese-owned social media platform facing the threat of a US ban unless it is acquired by an American entity.

US President Donald Trump hinted at a breakthrough, writing on his Truth Social account that “young people… will be very happy,” and promising further conversations with President Xi Jinping later this week.

The accusations against Nvidia mark another flashpoint in the ongoing technological rivalry between the two powers.

Washington has tightened restrictions on advanced chip exports to China, citing national security concerns, while Beijing in turn opened its probe into Nvidia last December—moves widely interpreted as tit-for-tat economic retaliation.

Semiconductors remain at the heart of the geopolitical contest.

Analysts say the Madrid talks were expected to weigh heavily on the future of chip supply chains and market access, given the role of Nvidia’s processors in powering artificial intelligence and high-performance computing worldwide.

Diplomatic watchers note that while both sides are keen to project progress, the combination of regulatory investigations, export controls, and looming political deadlines suggests that the competition for technological supremacy will define US-China relations for years to come.

-

Milestone5 days ago

Milestone5 days agoChief Chukwuma Johnbosco and the Making of a Purpose-Driven Leader

-

News5 days ago

News5 days agoUS Sends Troops to Nigeria Over Rising Terror Threats

-

Sports5 days ago

Sports5 days agoEx-Sri Lanka Star Jayasuriya Named in USA Squad for T20 World Cup

-

Sports5 days ago

Sports5 days agoLens Edge Le Havre to Reclaim Ligue 1 Top Spot

-

Sports5 days ago

Sports5 days agoJustin Rose Sets 36-Hole Record, Opens Four-Shot Lead at Torrey Pines

-

News5 days ago

News5 days agoMuammar Gaddafi’s Son, Saif al-Islam, Reportedly Shot Dead in Libya