Politics

China to Eliminate Tariffs on Imports from African Countries

China has announced plans to eliminate tariffs on imports from all 53 African countries with which it maintains diplomatic relations.

This policy shift aims to deepen trade relations and position China as a leading trade and investment partner for the continent.

The zero-tariff initiative, when fully implemented, would expand on a 2024 agreement that removed import duties on goods from 33 African nations classified as “least developed.”

The new policy will now include larger economies like Nigeria and South Africa, further deepening trade ties between Beijing and the continent.

However, Eswatini, the only African country that maintains diplomatic relations with Taiwan, is excluded from the deal.

Middle-income African countries with more developed manufacturing and export sectors are expected to benefit significantly from this arrangement.

Nations like Kenya, South Africa, Nigeria, Egypt, and Morocco will gain duty-free access to the Chinese market, enabling them to export a wider range of processed and value-added goods without tariff barriers.

China has also pledged additional support for smaller or less industrialized African economies, promising tailored programs to help them take advantage of the new trade benefits.

Despite the optimistic tone, trade between China and Africa continues to show a significant imbalance, with China enjoying a trade surplus of around $62 billion.

Analysts warn that unless African exports to China increase substantially, this disparity may grow.

The new tariff policy is seen as a strategic move to help rebalance trade flows and strengthen Beijing’s influence on the African continent.

This initiative follows broader economic commitments made by China, including a pledge of 360 billion yuan (approximately $50 billion) in credit lines and investments over a three-year period.

The move reflects Beijing’s ongoing efforts to cement its role as a key economic partner in Africa and offer an alternative to Western-led trade systems.

With the tariff walls coming down, African nations now face the dual challenge of scaling up production capacity and ensuring the quality of exports. If successfully harnessed, the opportunity could mark a new chapter in Africa–China relations—one defined by more equitable trade and shared prosperity.

Diplomacy

CARICOM Raises Alarm Over Political Crisis in Haiti

CARICOM Raises Alarm Over Political Crisis in Haiti

The Caribbean Community (CARICOM) has expressed deep concern over the escalating internal crisis within Haiti’s transitional government, warning that the unfolding turmoil threatens an already fragile governance process at a critical moment for the country.

In a statement, CARICOM said the instability at the highest levels of the Haitian state comes at a time when calm decision-making and a clear focus on the welfare of the Haitian people are urgently required from members of the executive.

The regional bloc recalled that, under the founding decree of the Transitional Presidential Council and the Political Accord of April 3, 2024, the mandate of the Council is due to expire on February 7, 2026.

CARICOM noted that the current deadlock within the Transitional Presidential Council, following unsuccessful attempts by some of its members to remove the Prime Minister, has further complicated an already difficult transition process.

The organisation lamented that while political actors remain locked in disputes, ordinary Haitians continue to endure widespread violence, insecurity and severe deprivation.

“This situation is unacceptable,” CARICOM said, stressing the need for all stakeholders to set aside their differences and urgently reach a consensus.

CARICOM added that its Eminent Persons Group remains available to assist Haitian stakeholders in finding common ground among the various proposals currently on the table.

The regional body said its overriding hope is for an end to the ongoing fragmentation, which it warned only serves the interests of armed gangs, and for the restoration of political stability, security and peace in Haiti.

According to CARICOM, achieving stability would pave the way for credible elections and allow renewed attention to be given to economic growth and sustainable development for the benefit of the Haitian people.

The Community called on all Haitian stakeholders to place the future of their country above personal or political interests and to act with urgency, responsibility and patriotism in the interest of national stability.

News

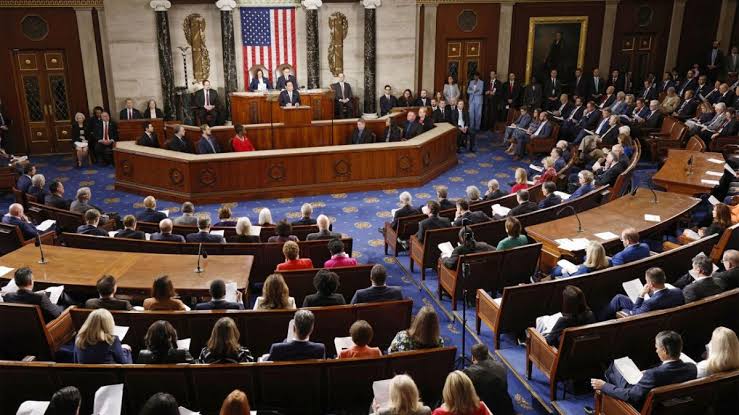

Court, Congress Pile Pressure on DHS Over Minnesota Operations

Court, Congress Pile Pressure on DHS Over Minnesota Operations

US House Democrats have threatened to begin impeachment proceedings against Homeland Security Secretary Kristi Noem over her handling of the immigration crackdown in Minnesota, unless President Donald Trump removes her from office.

House Minority Leader Hakeem Jeffries warned that Democrats could proceed “the easy way or the hard way,” describing the actions of Noem’s department as “disgusting.”

The crisis follows the fatal shooting of US citizen Alex Pretti by a federal agent, which has triggered backlash in Minneapolis and led to the planned departure of Border Patrol Chief Gregory Borvino and some agents from the city.

Trump has deployed his “border tsar,” Tom Homan, to take charge of on-the-ground operations, while a Minnesota judge has ordered acting ICE director Todd Lyons to appear in court over alleged violations of court orders.

Trump has distanced himself from claims by senior adviser Stephen Miller that Pretti was a “would-be assassin,” saying he did not believe the victim was acting as one.

Video footage shows Pretti holding a phone while filming agents, not a gun, although police say he was a legal firearm owner.

Diplomacy

Rwanda sues UK over scrapped migrant deal payments

Rwanda sues UK over scrapped migrant deal payments

The Rwandan government has initiated arbitration proceedings against the United Kingdom, seeking payments it says are owed under the now-abandoned asylum partnership agreement between both countries.

Rwanda has filed the case at the Permanent Court of Arbitration (PCA) in The Hague, arguing that the UK failed to honour financial commitments contained in the deal signed under the former Conservative government.

The agreement, designed to relocate some asylum seekers from the UK to Rwanda, was scrapped in 2024 by Prime Minister Sir Keir Starmer, with the Home Office saying about £220m in future payments would no longer be made.

UK authorities insist the policy was costly and ineffective, pledging to defend the case to protect taxpayers’ funds.

Rwanda, however, says the arbitration concerns unmet treaty obligations and is seeking a legal determination of both parties’ rights under international law.

The PCA lists the case as pending, with no timetable yet announced for hearings or a ruling.

-

Analysis6 days ago

Analysis6 days agoThe Agony of a Columnist, by Alabidun Shuaib AbdulRahman

-

Analysis5 days ago

Analysis5 days agoNow That Nigeria Has a U.S. Ambassador-Designate, by Boniface Ihiasota

-

Diplomacy5 days ago

Diplomacy5 days agoCARICOM Raises Alarm Over Political Crisis in Haiti

-

News6 days ago

News6 days agoMacron invites Chad’s Déby to Paris amid push to reset ties

-

News6 days ago

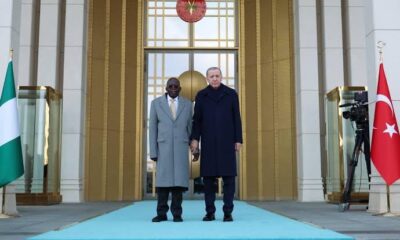

News6 days agoTinubu Unhurt After Brief Stumble at Turkey Reception

-

News6 days ago

News6 days agoCourt, Congress Pile Pressure on DHS Over Minnesota Operations