Diaspora

Innovate Africa Conference 2024 Sets Stage For Sustainable Growth And Prosperity

Africa’s Future In Focus: Innovate Africa Conference 2024 Set To Drive Growth

Innovate Africa Corp, in collaboration with Bild Foundation, is set to host the inaugural Innovate Africa Conference 2024 on September 13, 2024, at George Washington University, Washington DC, USA. This landmark event will bring together over 500 leaders from business, government, and academia to forge strategic partnerships and drive impactful solutions for Africa’s economic and infrastructural development.

“In these times of unprecedented global challenges, collaboration and innovation are more crucial than ever,” says Uloma Ogbuebile, Founder and CEO of Innovate Africa Corp. “The Innovate Africa Conference 2024 provides a unique platform for leaders to share insights and spearhead solutions that will shape Africa’s economic future.”

The conference, themed “Unleashing Africa’s Potential Sustainability,” will tackle critical challenges and explore vast opportunities in a rapidly changing global landscape. Participants can expect a day filled with groundbreaking ideas, inspiring speakers, and unparalleled networking opportunities.

A unique feature of the conference is the “Deal Room,” which will facilitate direct connections between investors and African businesses, allowing for the exploration and finalization of investment opportunities with the potential to drive substantial economic growth across the continent.

The event will culminate in a spectacular Gala Night on September 14, offering an exclusive opportunity to celebrate Africa’s achievements, network with influential leaders, and enjoy world-class entertainment.

Notable figures such as Chief Olusegun Obasanjo, Ameenah Gurib-Fakim, Dr. Ngozi Okonjo-Iweala, and Michael V. Roberts will participate and share invaluable insights throughout the event. Excel Global Media Group, owners of Diaspora Watch, is an official media partner of the Innovate Africa Conference 2024.

Join the conversation and be part of this transformative journey at the Innovate Africa Conference 2024.

Diaspora

Diaspora Watch Vol. 81

Diaspora Watch Newspaper has released its 81st edition, delivering a sharp, authoritative and globally attuned package of journalism that interrogates power, policy and influence at a critical moment in international affairs.

Diaspora Watch FREE DIGITAL VIEW: https://diasporawatch.com/3d-flip-book/diaspora-watch-vol-81/

On-Demand Print: https://www.magcloud.com/browse/issue/3259915?__r=1069759

SUBSCRIBE TO DIASPORA WATCH NOW ON THE LINK BELOW: https://diasporawatch.com/subscribe-to-diaspora-watch-newspaper/

This latest edition captures the shifting dynamics of global security, diplomacy and governance, with a lead focus on deepening U.S.–Nigeria security engagement against the backdrop of rising terror threats. The report probes the strategic calculations behind the move and what it means for regional stability, sovereignty and counter-terrorism cooperation in West Africa.

Beyond security, the edition reflects the volatility of a world in transition. From renewed uncertainty in Libya following reports surrounding Muammar Gaddafi’s son, to mounting tensions in the United States over federal immigration enforcement and public protest, Diaspora Watch situates breaking developments within their broader political and social contexts.

The newspaper also turns attention to the future, spotlighting technological innovation aimed at Africa’s digital inclusion, as well as urgent calls for stronger regional integration in the Caribbean amid global trade headwinds. Energy policy debates, evolving diplomatic relations between Africa and the United States, and the deepening humanitarian emergency in the Democratic Republic of Congo are examined with clarity, balance and depth.

Rounding out the edition is a culture-driven back-page story that blends politics, celebrity and controversy, underscoring how influence and perception increasingly intersect in the global public space.

With its 81st edition, Diaspora Watch Newspaper reinforces its position as a trusted platform for diaspora-focused journalism—bold in perspective, rigorous in reporting and committed to telling Africa’s story within a rapidly changing world.

Stay connected with the world around you – read Diaspora Watch today!

Celebrating African excellence and spotlighting pressing global issues.

#DiasporaWatch #AfricaInFocus #GlobalNews #CulturalVoices #AfricanPerspective

Diaspora

11 Killed, 14 Injured in Mass Shooting at South African Hostel

11 Killed, 14 Injured in Mass Shooting at South African Hostel

At least 11 people, including a three-year-old child, have been killed in a mass shooting at a hostel in Saulsville township, west of Pretoria, South Africa’s capital.

Police spokesperson Brigadier Athlenda Mathe said three unidentified gunmen stormed the premises around 4:30am on Saturday and fired “randomly” at a group of people who were drinking.

A 12-year-old boy and a 16-year-old girl were also among the dead.

Mathe confirmed that 25 people were shot in total, with 14 others wounded.

No arrests have been made, and the motive for the attack remains unclear.

Authorities described the venue as an “illegal shebeen,” noting that many mass shootings in the country occur in such unlicensed liquor spots.

Police shut down 12,000 illegal outlets between April and September and arrested more than 18,000 people nationwide.

South Africa continues to battle soaring violent crime.

According to UN data, the country recorded a murder rate of 45 per 100,000 people in 2023–24, while police statistics show that 63 people were killed daily between April and September.

Diaspora

Benin Foils Military Coup Attempt, 14 Arrested

Benin Foils Military Coup Attempt, 14 Arrested

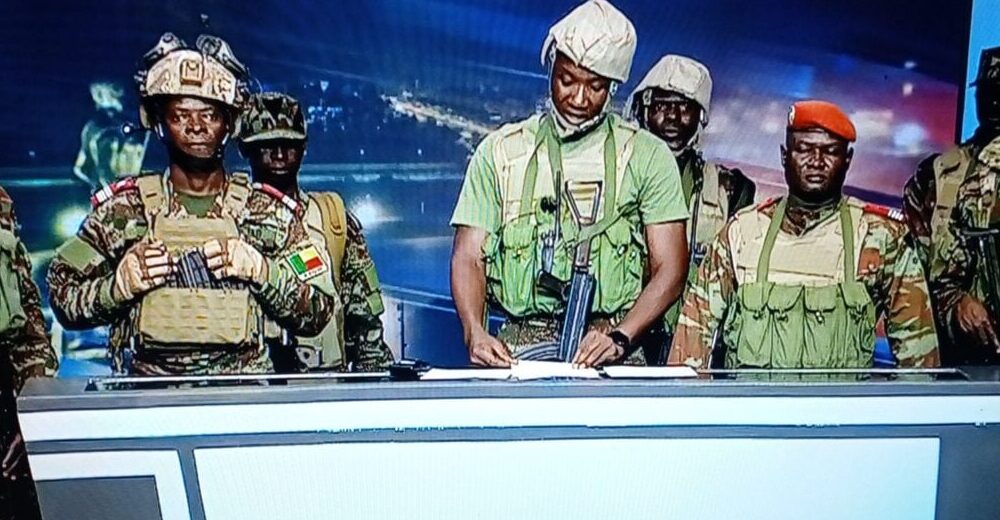

The government of Benin says it has thwarted an attempted coup after a group of soldiers tried to seize power in the early hours of Sunday.

Interior Minister Alassane Seidou, in a televised address, said the armed forces “remained committed to the republic” as loyalist troops moved swiftly to suppress what he described as “a mutiny aimed at destabilising the state and its institutions.”

Earlier, the renegade soldiers, led by Lt-Col Pascal Tigri, briefly took over the national television station and announced that President Patrice Talon had been removed.

It was reported that gunfire erupted near the presidential residence in Porto-Novo, while journalists at the state broadcaster were held hostage for several hours.

A presidential adviser later confirmed that Talon was safe, dismissing rumours that he had sought refuge at the French embassy.

French diplomats also denied the reports.

Government spokesperson Wilfried Leandre Houngbedji told Reuters that 14 people had been arrested so far.

A journalist in Cotonou said 12 of those detained were involved in storming the TV station, including a previously dismissed soldier.

The attempted takeover triggered heavy security deployment across Cotonou, with helicopters hovering overhead and major roads cordoned off.

Foreign embassies, including those of France, Russia, and the United States, issued advisories urging citizens to stay indoors.

In their broadcast, the rebel soldiers accused Talon of neglecting worsening insecurity in northern Benin, where militants linked to Islamic State and al-Qaeda have carried out deadly attacks near the borders with Niger and Burkina Faso.

They also protested rising taxes, cuts to public healthcare, and alleged political repression.

President Talon, 67, who came to power in 2016 and is expected to leave office next year after his second term, has faced growing criticism over democratic backsliding, including the barring of key opposition figures and recent constitutional amendments.

Sunday’s events add to a worrying pattern of military takeovers across West Africa, with recent coups in Burkina Faso, Guinea, Mali, Niger, and, just last week, Guinea-Bissau.

Ecowas, the AU, and Nigeria have all condemned the attempted coup in Benin, calling it a threat to regional stability.

Nigeria described the failed plot as a “direct assault on democracy” and commended Benin’s security forces for protecting the constitutional order.

-

Business4 days ago

Business4 days agoZenith Bank, Excel Global Media Discuss Strategic Partnership

-

News4 days ago

News4 days agoTrade, Tension as Trump Threatens US–Canada Bridge Opening

-

News4 days ago

News4 days agoSenegal Police Arrest 14 in Transnational Paedophile Ring Linked to France

-

News4 days ago

News4 days ago55 Migrants Perish as Boat Overturns Off Libyan Coast

-

Analysis4 days ago

Analysis4 days agoNigeria’s Tax Reforms and the Diaspora, by Boniface Ihiasota

-

News4 days ago

News4 days agoKenya to Engage Russia Over Illegal Recruitment of Citizens for Ukraine War