Diaspora

What’s in Trump’s ‘Big, Beautiful’ Bill That Just Passed the House

The United States House of Representatives narrowly passed a sweeping Republican tax and spending package on Thursday, marking a significant legislative victory for President Donald Trump.

Dubbed his “one big, beautiful bill,” the legislation now heads to the Senate, where it is expected to undergo notable revisions.

The bill is both ambitious and controversial, containing measures that target several key sectors, including healthcare, taxation, immigration, education, and social welfare.

A centerpiece of the bill is the permanent extension of the individual income tax cuts originally introduced in the GOP’s 2017 Tax Cuts and Jobs Act.

However, these cuts come at a steep price.

According to the Congressional Budget Office (CBO), the proposed tax changes would add approximately $3.8 trillion to the national debt over the next decade. Meanwhile, the legislation proposes deep spending cuts to vital safety net programs.

Medicaid funding would be slashed by nearly $700 billion, a number expected to rise once recent updates to the bill are assessed. Similarly, the Supplemental Nutrition Assistance Program (commonly known as food stamps) would lose $267 billion in federal support.

The bill includes measures that align with longstanding Republican policy goals and campaign promises made by President Trump.

These include significant investments in border security, enhanced systems to curb immigration, and the development of a massive new missile defense shield.

It also proposes a comprehensive overhaul of the air traffic control system, new fees targeting electric vehicle users, and a shift away from federal student loans.

To offset the cost of the tax breaks and increased defense and immigration-related spending, the House GOP aimed for at least $1.5 trillion in spending reductions.

However, Senate Republicans are likely to revise the bill, potentially softening some of the more aggressive cuts.

Because the legislation is advancing through budget reconciliation, it requires only a simple majority in the Senate, bypassing the need for Democratic support.

Among the most contentious provisions is the introduction of work requirements for Medicaid beneficiaries.

For the first time in the program’s six-decade history, non-exempt adults between the ages of 19 and 64 would need to work at least 80 hours per month or engage in approved activities like schooling or community service to retain coverage.

The implementation date has been moved up to the end of 2026, raising concerns that more people could lose coverage sooner.

Exceptions would apply to groups such as parents, pregnant women, medically frail individuals, and those with substance abuse disorders.

The legislation also mandates more frequent eligibility checks for Medicaid expansion recipients and requires certain low-income adults to contribute financially to their care.

It includes penalties for states that use their own funds to cover undocumented immigrants, reducing their federal Medicaid matching funds by 10%.

States would face new limitations on the taxes they can levy on healthcare providers, a revenue stream used to enhance provider reimbursements and health services.

A notable incentive was added for the ten states that have not expanded Medicaid. These states would be allowed to send larger supplemental payments to healthcare providers, potentially deterring them from expanding coverage.

Additionally, the bill delays a Biden administration rule intended to streamline Medicaid enrollment until 2035, which could make it harder for individuals to obtain or renew coverage.

Another controversial aspect of the bill involves changes to the Affordable Care Act (ACA).

It proposes codifying a Trump-era initiative that would shorten the ACA’s open enrollment period and eliminate year-round sign-up options for low-income individuals.

In a last-minute amendment, GOP lawmakers reinstated funding for cost-sharing reduction subsidies, which Trump had previously eliminated.

While this might lower out-of-pocket costs, it could reduce the generosity of premium subsidies, prompting some to drop their coverage.

According to early CBO estimates, these healthcare-related changes could lead to 8.6 million more people being uninsured by 2034—a figure expected to increase as the final provisions are analyzed.

The legislation also enhances the child tax credit, increasing it from $2,000 to $2,500 per child from 2025 through 2028.

However, eligibility is restricted to parents with Social Security numbers, eliminating access for those who file taxes using individual taxpayer identification numbers—typically undocumented immigrants—thereby affecting around two million children.

In a symbolic nod to Trump’s branding, the bill creates “Trump accounts,” officially named “money accounts for growth and advancement” (MAGA accounts).

These accounts would be established for U.S. citizen children born between 2025 and 2028, with an initial federal contribution of $1,000. Families could contribute up to $5,000 annually.

The funds, inaccessible until the child turns 18, could be used for higher education or first-time home purchases and would be taxed at capital gains rates. The account would expire when the beneficiary turns 31.

Fulfilling a major campaign pledge, the bill exempts income from tips and overtime from federal taxation for qualifying workers.

This applies specifically to traditionally tipped occupations and to hourly workers, excluding those earning more than $160,000 annually.

These tax breaks would be in effect from 2025 through 2028 and would also be available to non-itemizing taxpayers.

Senior citizens are not left out, as the bill increases their standard deduction by $4,000 from 2025 through 2028. However, this benefit phases out for individuals with incomes above $75,000 and couples earning more than $150,000.

This measure is positioned as an indirect fulfillment of Trump’s promise to eliminate taxes on Social Security benefits, which cannot be addressed under budget reconciliation rules.

The package introduces a temporary car loan interest deduction, allowing taxpayers to deduct up to $10,000 annually for interest on vehicles purchased after 2025, provided the cars are assembled in the U.S.

This benefit phases out for individuals earning more than $100,000 and couples earning above $200,000.

Other tax reliefs include a temporary boost to the standard deduction and permanent changes that favor wealthier Americans.

The estate tax exemption would be permanently set at $15 million per individual, adjusted for inflation.

The bill also enhances a deduction for owners of pass-through entities, such as partnerships and sole proprietorships, increasing it from 20% to 23%.

The legislation raises the cap on state and local tax (SALT) deductions to $40,000 for those earning up to $500,000, addressing long-standing concerns from lawmakers in high-tax states.

For single filers earning up to $250,000, the cap would be raised to $15,000. These adjustments would gradually phase back down and remain in effect until 2034.

Businesses also benefit from the bill, with the return of full, first-year deductions for equipment purchases and research and development costs, which had been curtailed in previous years. These provisions would expire after 2029.

Moreover, companies could temporarily write off expenses related to constructing or upgrading certain facilities, although deductions for purchases of professional sports teams would be limited.

Finally, the bill significantly increases taxes on universities and private foundations. The endowment tax rate for some universities would rise from 1.4% to as high as 21%, and private foundation taxes would jump to as much as 10%.

These measures aim to generate revenue but have sparked criticism from institutions that rely on endowment income for operational and scholarship support.

In summary, the House-passed bill is a comprehensive and controversial overhaul of the nation’s tax and spending priorities.

While it offers substantial tax relief and fulfills several of President Trump’s campaign promises, it does so at the expense of key social safety net programs and could result in millions of Americans losing healthcare coverage.

The Senate’s response to this bill will determine its final shape and its impact on the American people.

Diaspora

Diaspora Watch Vol. 81

Diaspora Watch Newspaper has released its 81st edition, delivering a sharp, authoritative and globally attuned package of journalism that interrogates power, policy and influence at a critical moment in international affairs.

Diaspora Watch FREE DIGITAL VIEW: https://diasporawatch.com/3d-flip-book/diaspora-watch-vol-81/

On-Demand Print: https://www.magcloud.com/browse/issue/3259915?__r=1069759

SUBSCRIBE TO DIASPORA WATCH NOW ON THE LINK BELOW: https://diasporawatch.com/subscribe-to-diaspora-watch-newspaper/

This latest edition captures the shifting dynamics of global security, diplomacy and governance, with a lead focus on deepening U.S.–Nigeria security engagement against the backdrop of rising terror threats. The report probes the strategic calculations behind the move and what it means for regional stability, sovereignty and counter-terrorism cooperation in West Africa.

Beyond security, the edition reflects the volatility of a world in transition. From renewed uncertainty in Libya following reports surrounding Muammar Gaddafi’s son, to mounting tensions in the United States over federal immigration enforcement and public protest, Diaspora Watch situates breaking developments within their broader political and social contexts.

The newspaper also turns attention to the future, spotlighting technological innovation aimed at Africa’s digital inclusion, as well as urgent calls for stronger regional integration in the Caribbean amid global trade headwinds. Energy policy debates, evolving diplomatic relations between Africa and the United States, and the deepening humanitarian emergency in the Democratic Republic of Congo are examined with clarity, balance and depth.

Rounding out the edition is a culture-driven back-page story that blends politics, celebrity and controversy, underscoring how influence and perception increasingly intersect in the global public space.

With its 81st edition, Diaspora Watch Newspaper reinforces its position as a trusted platform for diaspora-focused journalism—bold in perspective, rigorous in reporting and committed to telling Africa’s story within a rapidly changing world.

Stay connected with the world around you – read Diaspora Watch today!

Celebrating African excellence and spotlighting pressing global issues.

#DiasporaWatch #AfricaInFocus #GlobalNews #CulturalVoices #AfricanPerspective

Diaspora

11 Killed, 14 Injured in Mass Shooting at South African Hostel

11 Killed, 14 Injured in Mass Shooting at South African Hostel

At least 11 people, including a three-year-old child, have been killed in a mass shooting at a hostel in Saulsville township, west of Pretoria, South Africa’s capital.

Police spokesperson Brigadier Athlenda Mathe said three unidentified gunmen stormed the premises around 4:30am on Saturday and fired “randomly” at a group of people who were drinking.

A 12-year-old boy and a 16-year-old girl were also among the dead.

Mathe confirmed that 25 people were shot in total, with 14 others wounded.

No arrests have been made, and the motive for the attack remains unclear.

Authorities described the venue as an “illegal shebeen,” noting that many mass shootings in the country occur in such unlicensed liquor spots.

Police shut down 12,000 illegal outlets between April and September and arrested more than 18,000 people nationwide.

South Africa continues to battle soaring violent crime.

According to UN data, the country recorded a murder rate of 45 per 100,000 people in 2023–24, while police statistics show that 63 people were killed daily between April and September.

Diaspora

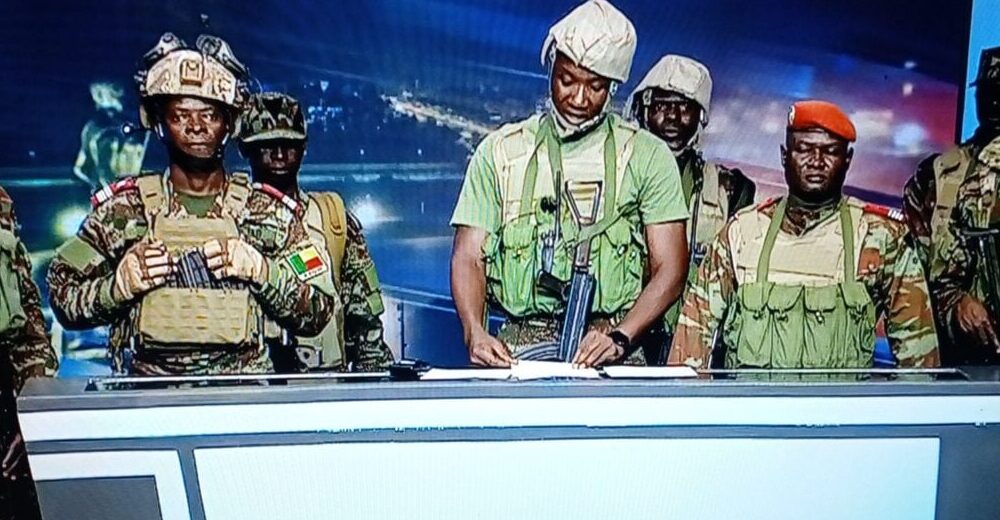

Benin Foils Military Coup Attempt, 14 Arrested

Benin Foils Military Coup Attempt, 14 Arrested

The government of Benin says it has thwarted an attempted coup after a group of soldiers tried to seize power in the early hours of Sunday.

Interior Minister Alassane Seidou, in a televised address, said the armed forces “remained committed to the republic” as loyalist troops moved swiftly to suppress what he described as “a mutiny aimed at destabilising the state and its institutions.”

Earlier, the renegade soldiers, led by Lt-Col Pascal Tigri, briefly took over the national television station and announced that President Patrice Talon had been removed.

It was reported that gunfire erupted near the presidential residence in Porto-Novo, while journalists at the state broadcaster were held hostage for several hours.

A presidential adviser later confirmed that Talon was safe, dismissing rumours that he had sought refuge at the French embassy.

French diplomats also denied the reports.

Government spokesperson Wilfried Leandre Houngbedji told Reuters that 14 people had been arrested so far.

A journalist in Cotonou said 12 of those detained were involved in storming the TV station, including a previously dismissed soldier.

The attempted takeover triggered heavy security deployment across Cotonou, with helicopters hovering overhead and major roads cordoned off.

Foreign embassies, including those of France, Russia, and the United States, issued advisories urging citizens to stay indoors.

In their broadcast, the rebel soldiers accused Talon of neglecting worsening insecurity in northern Benin, where militants linked to Islamic State and al-Qaeda have carried out deadly attacks near the borders with Niger and Burkina Faso.

They also protested rising taxes, cuts to public healthcare, and alleged political repression.

President Talon, 67, who came to power in 2016 and is expected to leave office next year after his second term, has faced growing criticism over democratic backsliding, including the barring of key opposition figures and recent constitutional amendments.

Sunday’s events add to a worrying pattern of military takeovers across West Africa, with recent coups in Burkina Faso, Guinea, Mali, Niger, and, just last week, Guinea-Bissau.

Ecowas, the AU, and Nigeria have all condemned the attempted coup in Benin, calling it a threat to regional stability.

Nigeria described the failed plot as a “direct assault on democracy” and commended Benin’s security forces for protecting the constitutional order.

-

Milestone4 days ago

Milestone4 days agoChief Chukwuma Johnbosco and the Making of a Purpose-Driven Leader

-

News4 days ago

News4 days agoUS Sends Troops to Nigeria Over Rising Terror Threats

-

Sports5 days ago

Sports5 days agoEx-Sri Lanka Star Jayasuriya Named in USA Squad for T20 World Cup

-

Sports5 days ago

Sports5 days agoLens Edge Le Havre to Reclaim Ligue 1 Top Spot

-

Sports5 days ago

Sports5 days agoJustin Rose Sets 36-Hole Record, Opens Four-Shot Lead at Torrey Pines

-

News4 days ago

News4 days agoMuammar Gaddafi’s Son, Saif al-Islam, Reportedly Shot Dead in Libya