Business

Trusted Advisor Adolphus Ukaegbu: Your Ultimate Real Estate Partner In Silver Spring

Finding the perfect home can be a daunting task, but with the right guide, it can be a stress-free and exciting experience! Diaspora Watch can report that Sir. Adolphus Ukaegbu, a seasoned real estate agent with Long & Foster Greater Silver Spring, is the trusted advisor you need to achieve your homeownership dreams. With his extensive knowledge and dedication,

Adolphus is more than just a real estate agent – he’s a skilled negotiator, a keen house-hunter, and a neighborhood expert. Whether you’re buying, selling, renting, or just exploring, Adolphus provides diligent support every step of the way, ensuring a seamless and successful real estate experience.

Working with Adolphus means you gain the support of the extensive Long & Foster network, spanning the Mid-Atlantic and Northeast regions, including global corporate affiliations, partnerships, and a wide range of companies offering services in mortgage, title, insurance, relocation, property management, and vacation rentals.

Adolphus specializes in various areas of real estate, including Investment Property, New Construction, First Time Home Buyers, Relocations, Rentals, Horse Farms, Country Homes, Foreclosure, Short Sales, REO Properties, Senior Living, Resale Residential, Historic Homes, Suburban Living, Condominiums, Eco-friendly Design and Construction, Urban Living, Water Front, Serving The Military, Single Family Homes, and Townhomes.

He serves a wide range of cities, including Washington, Adelphi, Barnesville, Beallsville, Beltsville, Berwyn, Berwyn Heights, Bethesda, Bladensburg, Bowie, Boyds, Brandywine, Brentwood, Brookeville, and Silver Spring, and his extensive reach covers multiple counties, including the District of Columbia, Howard, Montgomery, and Prince Georges.

Adolphus is fluent in Igbo, enabling him to assist a diverse clientele effectively. For a stress-free and successful real estate experience, visit him at Long & Foster Greater Silver Spring, located at 12520 Prosperity Drive, Suite 105, Silver Spring, MD 20904. Experience the difference that a dedicated and knowledgeable agent can make in your real estate journey!

Business

Dollar Rebounds as Traders Eye Possible Fed Rate Cut in September

Dollar Rebounds as Traders Eye Possible Fed Rate Cut in September

The U.S. dollar staged a rebound on Monday, gaining ground against major currencies after suffering sharp losses last week on the back of dovish comments from Federal Reserve Chair Jerome Powell, which had strengthened expectations of an interest rate cut in September.

The dollar index, which measures the greenback’s performance against a basket of six major currencies, rose by 0.49 per cent to 98.32, marking its biggest daily advance since July 30.

The euro slipped 0.69 per cent to $1.1634, retreating from Friday’s four-week high of $1.1742.

The rebound comes as global markets weigh Powell’s remarks that risks to the U.S. labour market are rising, even though inflation remains a concern.

Analysts at Barclays, BNP Paribas and Deutsche Bank now project a 25-basis-point rate cut by the Fed at its September meeting.

“While Powell and company are undoubtedly still leaning toward cutting interest rates next month, upcoming U.S. economic data could sway the decision,” said Matt Weller, global head of market research at StoneX.

“Forex traders are hedging their bets as a September cut isn’t guaranteed, and the dollar’s modest recovery reflects that caution.”

Market pricing showed an 84.3 per cent probability of a September rate cut, according to CME’s FedWatch tool — a slight dip from 84.7 per cent in the prior session but well above the 61.9 per cent recorded a month ago.

Meanwhile, U.S. stocks closed weaker on Monday, with the Dow Jones Industrial Average dropping more than 0.75 per cent, the S&P 500 falling by 0.4 per cent, and the Nasdaq slipping by 0.2 per cent.

Treasury yields also edged higher, with the two-year note, which is highly sensitive to Fed expectations, up four basis points at 3.728 per cent.

Across the Atlantic, euro zone bond yields climbed as traders recalibrated their outlook, aided by data showing a pickup in German business confidence.

Germany’s 10-year yield rose 3.9 basis points to 2.758 per cent, close to a five-month peak of 2.787 per cent.

Despite Monday’s recovery, the dollar remains under pressure, having weakened by more than nine per cent so far this year, while the euro has gained over 12 per cent.

Analysts such as Samy Chaar, chief economist at Lombard Odier, predict the euro could strengthen further to $1.20–$1.22 within the next year.

Investor attention is also fixed on escalating tensions between President Donald Trump and the Federal Reserve, with Trump’s repeated criticism of Powell and other Fed officials raising fresh concerns about the central bank’s independence at a sensitive time for monetary policy.

Business

IEA Warns of Record Oil Glut in 2026 as Supply Outpaces Demand Growth

IEA Warns of Record Oil Glut in 2026 as Supply Outpaces Demand Growth

Global oil markets are headed for a record supply surplus next year, with production growth far outstripping demand, the International Energy Agency (IEA) has warned.

In its latest monthly oil market report, the Paris-based body projected that oil inventories could grow by 2.96 million barrels per day (bpd) in 2026 — a buildup even higher than the average surplus recorded during the COVID-19 pandemic year of 2020.

The IEA said world oil demand growth this year and next will slow to less than half the pace seen in 2023, weighed down by weaker consumption in major markets like China, India and Brazil.

Global consumption is forecast to expand by only 680,000 bpd in 2025 — the slowest since 2019 — before inching up by 700,000 bpd in 2026.

Meanwhile, supplies are surging. The OPEC+ alliance, led by Saudi Arabia, has accelerated the restart of previously halted production, while output outside the group — particularly from the U.S., Guyana, Canada and Brazil — is also rising.

The agency revised its forecast for non-OPEC+ supply growth in 2026 upward by 100,000 bpd to 1 million bpd.

“Oil-market balances look ever more bloated as forecast supply far eclipses demand towards year-end and in 2026,” the IEA stated.

“It is clear that something will have to give for the market to balance.”

Crude prices have already slipped about 12% this year, trading near $66 per barrel in London, amid concerns that U.S. President Donald Trump’s ongoing trade war could dampen global economic growth.

While the price drop offers relief to consumers and a political win for Trump’s push for lower fuel costs, it poses significant financial challenges for oil-producing nations and companies.

Oil markets are currently drawing some support from strong summer demand for transportation fuels, but the IEA noted that inventories — which hit a 46-month high in June — suggest oversupply pressures are already in play.

It added that new geopolitical shocks, such as sanctions on Russia or Iran, could still reshape the outlook.

The projected glut would be the largest annual surplus on record, although the second quarter of 2020 — when lockdowns slashed demand by over 7 million bpd — remains the biggest quarterly excess in history.

Business

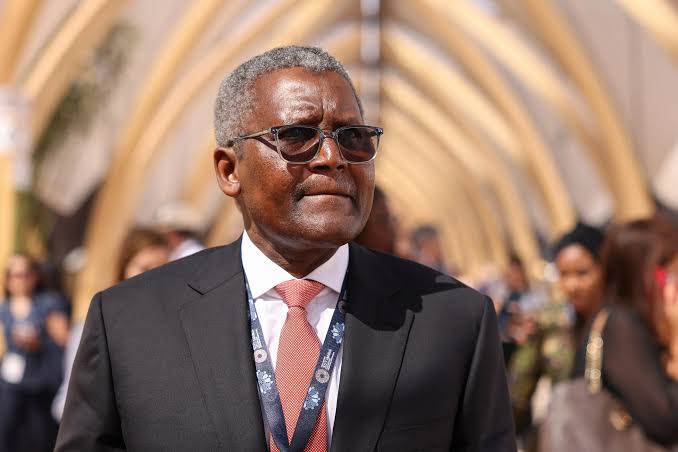

Dangote Inches Closer to Historic $30bn Net Worth Mark

Dangote Inches Closer to Historic $30bn Net Worth Mark

Africa’s richest man, Aliko Dangote, is edging closer to the historic $30 billion milestone, with Bloomberg’s real-time Billionaires Index currently valuing his net worth at $29.3 billion.

The development follows a year-to-date rise of almost $1.2 billion, fuelling fresh speculation that the Nigerian industrialist may soon become the continent’s first-ever $30 billion man.

The surge is particularly significant given a volatile year that has seen wide swings in the valuation of Dangote’s fortune.

At the start of 2025, the billionaire’s wealth was pegged at $28.1 billion, before dipping to $27.7 billion by mid-year.

In April, Bloomberg reported a modest year-to-date gain of just $153 million, confirming the sensitivity of these figures to shifts in market prices, currency movements, and company results.

Dangote’s fortune is anchored in his publicly listed companies—Dangote Cement, Dangote Sugar, and NASCON—which collectively account for the bulk of his visible assets.

According to market trackers, Dangote Cement is valued at $5.54 billion, Dangote Sugar at $357 million, United Bank for Africa (UBA) shares at $484,000, and NASCON at $117 million.

The billionaire’s year-to-date gain has been credited to strong share price movements on the Nigerian Exchange, buoyed by improved company results and better macroeconomic indicators in the Nigerian economy.

Beyond the listed firms, investors continue to pin heightened expectations on the $20 billion Dangote Petroleum Refinery, an integrated refinery and petrochemical complex in Lekki.

Although unlisted—and therefore assessed through simulated valuations—the refinery is widely regarded as the most transformative asset in Dangote’s portfolio, with analysts consistently citing its future export potential and cash flow prospects as major drivers of his rising fortune.

Market watchers say the difference between Dangote’s current wealth and the symbolic $30 billion mark is just about $700 million.

Given recent surges that have added hundreds of millions in value within days, some analysts argue that the milestone could be reached within weeks if market momentum continues or if a favourable re-rating of his refinery assets occurs.

For now, the big question remains: is the $30 billion threshold imminent, or merely headline hype? What is certain, however, is that Dangote’s business empire—spanning cement, sugar, salt, and petroleum—remains the single most significant wealth story out of Africa.