Diaspora

Peter Obi Says Nigeria Among World’s Most Insecure Nations

Former governor of Anambra State and presidential candidate of Labour Party in 2023 election, Mr Peter Obi has lamented the level of insecurity in Nigeria, saying that killings and abductions taking place in every part of the country has placed it among the most insecure nations in the world.

Obi who spoke to journalists in Onitsha called on leaders to double their efforts, saying that if nothing was done, the country may slide into a failed nation. He also called for the release of the detained leader of Indigenous People of Biafra (IPOB), Mazi Nnamdi Kanu, and others freedom fighters and EndSARS protesters, while efforts are made to better engage in dialogue.

He said: “The primary work of government is the security of lives and property. It is the foundation on which people can live in any nation because no one can stay in an insecure place.

“It is worrisome what is happening in Nigeria with the news of killings, abductions and others have made Nigeria one of the most insecure places on the surface of the earth. In fact, it is leading to a failed nation.

“I thank government for their efforts so far, but there is need to do more, and all leaders must come together to join hands and fight this. In the South east, there is need for the governors of the South East to come together to be able to tackle it. “Even in economic agenda, I want to see the South east governors work closely more. We want to see them come together and also bring together other groups in the zone.” Giving his views on the continued detention of Kanu, Obi said: “I don’t see any reason for his contin-ued detention, especially as the courts have granted him bail. Government must obey the court.

“Rule of law is an intricate asset that we must cherish and live with. I use this opportunity to plead with government to ensure that all those who are in similar conditions are released and discussed with. We are in a democracy and we should not be doing things that are arbitrary and not within the law.” Speaking about protest in Kenya and if he supports Nigeria’s to do same, the former governor said: “I’m against riot or destruction of government assets and property, because it is still scarce resources that we are going to use to repair them, but I’m not against peaceful protests. “Peaceful protest is allowed, but it must be for a reason and not personal interest of some people to satisfy a particular interest. It must be properly articulated and properly directed.

“I recall when people said they were protesting police brutality and I said to them no, let’s rather deal with the leadership. If we have good leaders, their agents can’t be bad. The problem is leadership. If the leaders are competent, have the capacity and doing the right thing, their agents will follow their examples.

Diaspora

11 Killed, 14 Injured in Mass Shooting at South African Hostel

11 Killed, 14 Injured in Mass Shooting at South African Hostel

At least 11 people, including a three-year-old child, have been killed in a mass shooting at a hostel in Saulsville township, west of Pretoria, South Africa’s capital.

Police spokesperson Brigadier Athlenda Mathe said three unidentified gunmen stormed the premises around 4:30am on Saturday and fired “randomly” at a group of people who were drinking.

A 12-year-old boy and a 16-year-old girl were also among the dead.

Mathe confirmed that 25 people were shot in total, with 14 others wounded.

No arrests have been made, and the motive for the attack remains unclear.

Authorities described the venue as an “illegal shebeen,” noting that many mass shootings in the country occur in such unlicensed liquor spots.

Police shut down 12,000 illegal outlets between April and September and arrested more than 18,000 people nationwide.

South Africa continues to battle soaring violent crime.

According to UN data, the country recorded a murder rate of 45 per 100,000 people in 2023–24, while police statistics show that 63 people were killed daily between April and September.

Diaspora

Benin Foils Military Coup Attempt, 14 Arrested

Benin Foils Military Coup Attempt, 14 Arrested

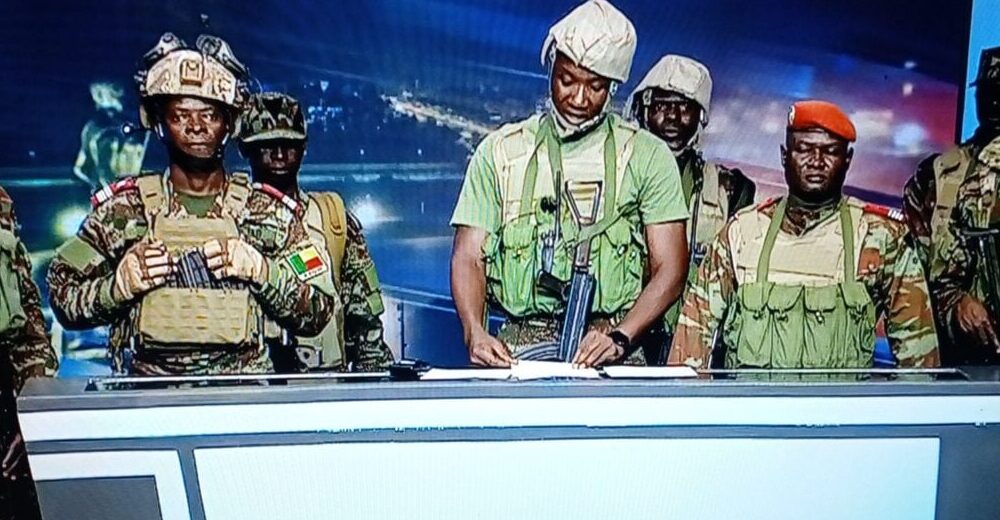

The government of Benin says it has thwarted an attempted coup after a group of soldiers tried to seize power in the early hours of Sunday.

Interior Minister Alassane Seidou, in a televised address, said the armed forces “remained committed to the republic” as loyalist troops moved swiftly to suppress what he described as “a mutiny aimed at destabilising the state and its institutions.”

Earlier, the renegade soldiers, led by Lt-Col Pascal Tigri, briefly took over the national television station and announced that President Patrice Talon had been removed.

It was reported that gunfire erupted near the presidential residence in Porto-Novo, while journalists at the state broadcaster were held hostage for several hours.

A presidential adviser later confirmed that Talon was safe, dismissing rumours that he had sought refuge at the French embassy.

French diplomats also denied the reports.

Government spokesperson Wilfried Leandre Houngbedji told Reuters that 14 people had been arrested so far.

A journalist in Cotonou said 12 of those detained were involved in storming the TV station, including a previously dismissed soldier.

The attempted takeover triggered heavy security deployment across Cotonou, with helicopters hovering overhead and major roads cordoned off.

Foreign embassies, including those of France, Russia, and the United States, issued advisories urging citizens to stay indoors.

In their broadcast, the rebel soldiers accused Talon of neglecting worsening insecurity in northern Benin, where militants linked to Islamic State and al-Qaeda have carried out deadly attacks near the borders with Niger and Burkina Faso.

They also protested rising taxes, cuts to public healthcare, and alleged political repression.

President Talon, 67, who came to power in 2016 and is expected to leave office next year after his second term, has faced growing criticism over democratic backsliding, including the barring of key opposition figures and recent constitutional amendments.

Sunday’s events add to a worrying pattern of military takeovers across West Africa, with recent coups in Burkina Faso, Guinea, Mali, Niger, and, just last week, Guinea-Bissau.

Ecowas, the AU, and Nigeria have all condemned the attempted coup in Benin, calling it a threat to regional stability.

Nigeria described the failed plot as a “direct assault on democracy” and commended Benin’s security forces for protecting the constitutional order.

Diaspora

Killings in Nigeria: ‘Enough is Enough,’ SNG-USA Cries Out from U.S. Capitol

Killings in Nigeria: ‘Enough is Enough,’ SNG-USA Cries Out from U.S. Capitol

By Boniface Ihiasota, USA

The Save Nigeria Group USA (SNG-USA) has intensified calls for urgent international action to halt what it described as a full-scale genocide against Christians in Nigeria.

Its President, Stephen Osemwegie, led a major rally at the U.S. Capitol Grounds in Washington, D.C., drawing Nigerians, Americans, clergy, human rights advocates and members of the diaspora to stand in solidarity with victims of violence.

Addressing the crowd in frigid weather, Osemwegie said millions of Christians across several Nigerian states live under constant threat of attacks.

He detailed a series of atrocities, including beheaded pastors, torched churches, abducted women and children, razed villages and wiped-out communities, insisting that the violence had long surpassed communal clashes and now represented a coordinated effort to annihilate Christian populations.

He cited the recent abduction of more than 300 pupils of Saint Mary’s Catholic School as evidence of the systematic nature of the attacks.

Osemwegie accused the Nigerian government of failing to uphold its constitutional responsibility to protect citizens, describing the 1999 Constitution as “a document imposed by soldiers” that had created a centralized system empowering extremists while weakening regional autonomy and endangering minority communities.

He called for a return to a constitutional framework similar to that of 1960, which he said would restore balanced governance and empower regions to safeguard their people.

The SNG-USA president commended U.S. President Donald J. Trump for redesignating Nigeria as a Country of Particular Concern (CPC), praising him for moral clarity and willingness to act when others remained silent.

He urged the U.S. Government to enforce the designation fully, including sanctions, visa restrictions, and asset freezes against individuals, officials, and networks allegedly involved in terror financing, mass displacement, or the concealment of atrocities.

Osemwegie also called on U.S. Senate and House leadership to act with urgency, warning that every delay could cost more lives.

He appealed to Senate Republican Leader John Thune to advance Senator Ted Cruz’s legislation targeting violent extremist groups and their sponsors, and urged House Speaker Mike Johnson to move forward with resolutions formally recognising the killings of Christians in Nigeria as genocide.

He further demanded the release of thousands of pages of FBI documents allegedly related to criminal investigations involving Nigeria’s President, stressing that transparency was essential for both American and Nigerian interests.

Highlighting the case of Sunday Jackson, a Christian farmer reportedly sentenced to death for defending his community from attacks, Osemwegie said the situation reflected a justice system in which “killers walk free while defenders face execution.”

He emphasised that the movement was driven by conscience and divine instruction, and vowed that the group would continue to speak for the voiceless and defend the persecuted.

Following the rally, SNG-USA issued a statement reaffirming its position and thanking American political leaders for engaging with the group.

It expressed appreciation to Donald Trump for considering its appeals, to Senators Thune and Ted Cruz for their leadership, and to House Speaker Mike Johnson and Congressmen Riley Moore and Chris Smith for meeting with its delegation.

The group also offered condolences to Congressman Moore and the people of West Virginia over the deaths of recently fallen members of the West Virginia National Guard.

The statement revealed that senior officials of the U.S. Department of State held a two-hour closed-door meeting with SNG-USA representatives, during which survivors of attacks provided firsthand testimonies.

The organisation expressed optimism about the State Department’s willingness to listen and commitment to global religious freedom.

SNG-USA also acknowledged U.S. media outlets for hthe crisis. It thanked clergy, human rights organisations, Nigerian-American communities, and other supporters who participated in the rally despite freezing temperatures.

Osemwegie concluded by pledging that the group would remain resolute until justice is served, the killings stop, and displaced Christians are restored to their homes. He declared, “We will not stop until the genocide ends.”

-

Business12 hours ago

Business12 hours agoTaxation and the Nigerian Diaspora

-

Analysis6 days ago

Analysis6 days agoBuhari, Power and the Burden of Integrity, by Alabidun Shuaib AbdulRahman

-

Analysis17 hours ago

Analysis17 hours agoAre Forest Guards to the Rescue? By Alabidun Shuaib AbdulRahman

-

News16 hours ago

News16 hours agoTwo Dead as Anthony Joshua Involved in Road Crash in Nigeria

-

News12 hours ago

News12 hours agoChina Launches Major Military Drills Around Taiwan

-

News12 hours ago

News12 hours agoNigeria Writes Off $1.42bn, N5.57trn Legacy NNPCL Debts After Reconciliation