Oil and Gas

U.S. Oil Industry Bleeds Jobs, Cuts Spending as Prices Slide

U.S. Oil Industry Bleeds Jobs, Cuts Spending as Prices Slide

The United States oil sector is facing mounting pressure as falling crude prices, industry consolidation and sweeping cost cuts threaten to end the rapid production growth that had elevated the country to the world’s top producer.

Thousands of workers have been laid off while companies slash billions of dollars in capital spending, fuelling fears that U.S. output may plateau or even decline — a shift that could erode Washington’s influence in global energy markets and complicate President Donald Trump’s energy dominance agenda.

On Sunday, the Organization of the Petroleum Exporting Countries and its allies (OPEC+), announced plans to increase production by 137,000 barrels per day beginning in October.

Analysts view the move as part of the cartel’s strategy to claw back market share lost to U.S. shale producers in recent years.

The production hike has further pressured global oil benchmarks, with prices sliding nearly 12 per cent this year.

U.S. West Texas Intermediate (WTI) futures traded at $62.15 per barrel on Monday — a level close to breakeven for many American producers.

Experts say drilling activity is unlikely to recover unless prices stabilise between $70 and $75 per barrel.

Industry leaders have warned that the financial squeeze is taking a toll. ConocoPhillips, the country’s third-largest oil producer, said it would cut up to 25 per cent of its workforce.

Chevron also announced plans to lay off about 8,000 employees, representing 20 per cent of its global staff.

Oilfield service giants SLB and Halliburton have similarly reduced headcount.

A Reuters analysis found that 22 publicly listed U.S. oil producers — including Occidental Petroleum, ConocoPhillips, and Diamondback Energy — have collectively trimmed capital expenditure by $2 billion this year.

Major players such as ExxonMobil and Chevron were not included in the study but are also expected to scale back investments.

The rig count, a key barometer of drilling activity, has dropped by 69 so far this year, bringing the total to 414, according to data from Baker Hughes.

The decline signals further pressure on future output levels.

As of late August, crude production from the lower 48 states stood at about 13.4 million barrels per day, marginally below the record 13.6 million barrels per day achieved in December 2024.

Analysts caution that if current trends persist, the U.S. could struggle to maintain its status as a swing producer, leaving OPEC+ with more leverage in shaping global oil supply and prices.

News

Nigeria Writes Off $1.42bn, N5.57trn Legacy NNPCL Debts After Reconciliation

Nigeria Writes Off $1.42bn, N5.57trn Legacy NNPCL Debts After Reconciliation

The Nigerian Government has written off the bulk of legacy debts owed by the Nigerian National Petroleum Company Limited (NNPCL) to the Federation Account, clearing about $1.42 billion and N5.57 trillion following a reconciliation exercise approved by President Bola Tinubu.

The decision is contained in a regulatory document prepared by the Nigerian Upstream Petroleum Regulatory Commission (NUPRC) and presented at the November meeting of the Federation Account Allocation Committee (FAAC).

The move effectively settles long-standing balances arising from crude oil liftings, production-sharing contracts and joint venture royalties accumulated up to December 31, 2024.

According to the commission, the approval followed the recommendations of a stakeholder committee constituted to reconcile claims between the national oil company and the Federal Government.

“However, the commission recently received a Presidential Approval to nil off the outstanding obligations of NNPC Ltd as at 31st December 2024 as submitted by the Stakeholder Alignment Committee on the Reconciliation of Indebtedness between NNPC Ltd and the Federation,” the document stated.

Before the adjustment, outstanding obligations reported to FAAC stood at about $1.48 billion and N6.33 trillion.

Following the reconciliation, most of the balances were removed from the Federation’s books.

“Consequently, out of $1,480,610,652.58 and N6,332,884,316,237.13, the affected outstanding obligations that have been nil off are $1,421,727,723.00 and N5,573,895,769,388.45. The commission has passed the appropriate accounting entries as approved,” the regulator said.

An analysis of the figures shows that the write-off represents about 96 per cent of the dollar-denominated debt and roughly 88 per cent of the naira obligations previously classified as outstanding.

Officials familiar with the process said the decision was aimed at resolving years of disputes over historical claims between the parties and allowing both the Federation and NNPCL to operate with cleaner balance sheets going forward.

The NUPRC, however, clarified that the approval does not cover liabilities incurred in 2025.

Statutory obligations arising between January and October this year remain outstanding, with balances of about $56.8 million and N1.02 trillion linked to lifting-related charges and joint venture royalties.

The commission disclosed that part of the dollar-denominated liabilities had been recovered during the period under review.

“However, the commission received $55,003,997.00 in the month under review from the outstanding, leaving a balance of $1,804,755.32 and N1,021,550,672,578.87. The amount of $55,003,997.00 received is part of the total collection reported above for sharing by the Federation this month,” the document added.

The debt relief comes against the backdrop of weaker upstream revenue performance.

Data in the same FAAC document show that the commission fell short of its approved monthly revenue target for November by more than N540 billion, largely due to lower-than-expected royalty receipts from oil and gas production.

Actual collections in the month also declined compared with October levels.

Oil and Gas

China Shuns US Crude for Third Straight Month

China Shuns US Crude for Third Straight Month

China’s decision to avoid purchasing US crude for the third straight month has dealt a fresh blow to shale drillers, who are already grappling with lower oil prices.

According to US Census data released on Thursday, the world’s biggest oil importer bought no American crude in May, following zero purchases in both March and April.

The absence of Chinese buying sent US overseas oil sales tumbling to the lowest in two years, further exacerbating the challenges faced by shale drillers.

These producers partly depend on foreign demand to keep drilling and avoid US markets from becoming oversupplied.

The current situation is attributed to the ongoing trade dispute between the US and China, which has led to tariffs being imposed on several countries, including China.

Chinese goods currently face levies of roughly 55 percent, making it difficult for US crude exporters to compete in the Chinese market.

Benchmark West Texas Intermediate prices have recently pulled back below $70 a barrel as geopolitical tensions ease and OPEC+ considers bringing back more production.

This has further squeezed shale drillers, who are struggling to maintain profitability in a challenging market environment.

The prolonged absence of Chinese buying is a significant concern for US shale producers, who rely heavily on foreign demand to support their operations.

With no immediate resolution to the trade dispute in sight, shale drillers may need to reassess their strategies to remain competitive in a rapidly changing market

-

Analysis6 days ago

Analysis6 days agoThe Agony of a Columnist, by Alabidun Shuaib AbdulRahman

-

Analysis5 days ago

Analysis5 days agoNow That Nigeria Has a U.S. Ambassador-Designate, by Boniface Ihiasota

-

Diplomacy5 days ago

Diplomacy5 days agoCARICOM Raises Alarm Over Political Crisis in Haiti

-

News6 days ago

News6 days agoCourt, Congress Pile Pressure on DHS Over Minnesota Operations

-

News6 days ago

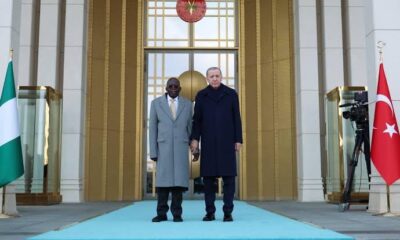

News6 days agoTinubu Unhurt After Brief Stumble at Turkey Reception

-

News6 days ago

News6 days agoMacron invites Chad’s Déby to Paris amid push to reset ties